While investors have come to expect sharp swings in equity markets in recent years, bouts of volatility in bond markets have become a key source of concern for some, as asset classes within investor portfolios become increasingly correlated. While developed market government bonds typically carry the lowest risk of default in bond markets, the risk of price fluctuations remains high, particularly in a climate where speculation over changes in monetary policy is high. Considering this, can investors still class government bonds as low risk? Additionally, after a decade of relatively strong returns from government bonds, should investors shy away from government bonds in 2022?

Government Bond Market Volatility

A key reason behind the elevated volatility in government bond markets is liquidity issues. Referring to the ease with which an investor can buy or sell an asset, liquidity has lagged in recent years in bond markets, and the discrepancy between demand and supply for government bonds is expected to worsen as hotter-than-expected inflation causes uncertainty over the rate at which the fed will tighten monetary policy. On a historical basis, periods of volatility tend to emerge in government bond markets when hawkish shifts in central bank policy loom over the market.

For example, in the current macroeconomic climate, with central banks promising to raise rates numerous times alongside shrinking their balance sheets, investors can expect to see a slowdown in buyers for government bonds. In addition, to help fund the expansion in government debt following pandemic era stimulus, the supply of government bonds has rapidly increased in recent years. The mismatch in liquidity for bonds is making them increasingly unpredictable, and for as long as there is uncertainty surrounding the speed at which policy is tightened, we expect government bond markets to maintain or even increase their volatility as this year progresses.

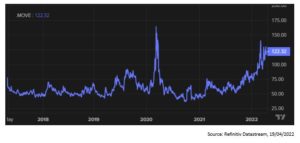

To demonstrate the recent volatility in bond markets, we look towards the Merrill Lynch Option Volatility Estimate or MOVE index. The MOVE index measures US interest rate volatility, with the index rising as expectations for interest rate hikes rise. As such, it can be seen as a ‘fear index’ in bond markets. The chart below illustrates that the current level of the MOVE Index is somewhat higher than the long run average, that stands around 70. While the MOVE index should not be used alone as a leading indicator, sharp increases in its value such as the move seen towards the end of 2021, can indicate that there is underlying activity within bond markets which should be investigated further.

How Have Fund Managers Responded?

Considering rising volatility in government bond markets, many fund managers are taking action to mitigate further price swings. Hedges have so far included floating rate notes as well as inflation-linked bonds, however due to assets becoming increasingly correlated, bond market volatility will have an impact on equity investors and other speculative assets too. That being said, another area that has seen outperformance in the face of falling bond prices is high dividend strategies, which still remain relatively inexpensive with a price to earnings ratio in the region of 17, compared to the broader equity market average of 23.

Our View

Although investors tend to view government debt as a safe haven, particularly in developed markets where default risk is low, in high inflationary economic environments and during cycles of monetary policy tightening, the risk associated with these assets increases. This does not stem from a greater risk of default, however with rising inflation, the rate of return in terms of purchasing power is likely to be significantly less should the bond be held to maturity. If not held for the full duration, investors must consider the risk of higher levels of volatility and potential for declining prices within bond markets as alternative hedges against inflation such as commodities, property or even defensive equity become increasingly sought after.

Important Information:

Past performance cannot be used as a guide to future performance and the value of your investment will fall as well as rise in value. You may not get back all of your investment and the final value of your investment will depend on the performance of your portfolio. The actual performance of an individual client’s portfolio may differ due to different funds being used and being restricted in relation to certain asset allocations. Performance figures quoted include fund manager charges but exclude adviser, discretionary, custodian and switch charges. Unless stated, income is reinvested into the portfolio. The information contained in in this document is for information purposes only. It does not constitute advice or a recommendation or an offer or solicitation for investment.